oklahoma auto sales tax and fees

An example of an item that exempt from Oklahoma is prescription medication. Be that condition above or below average.

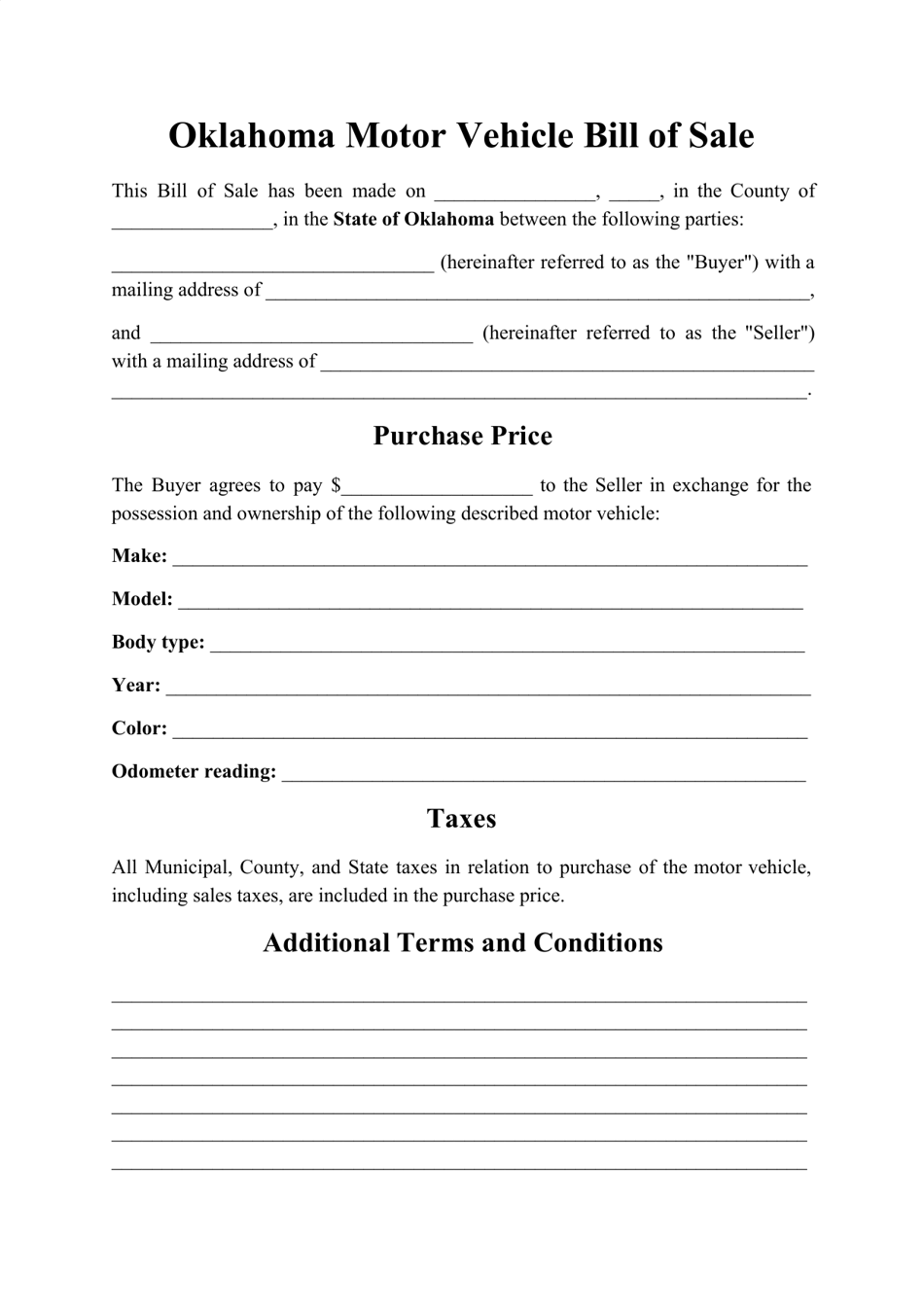

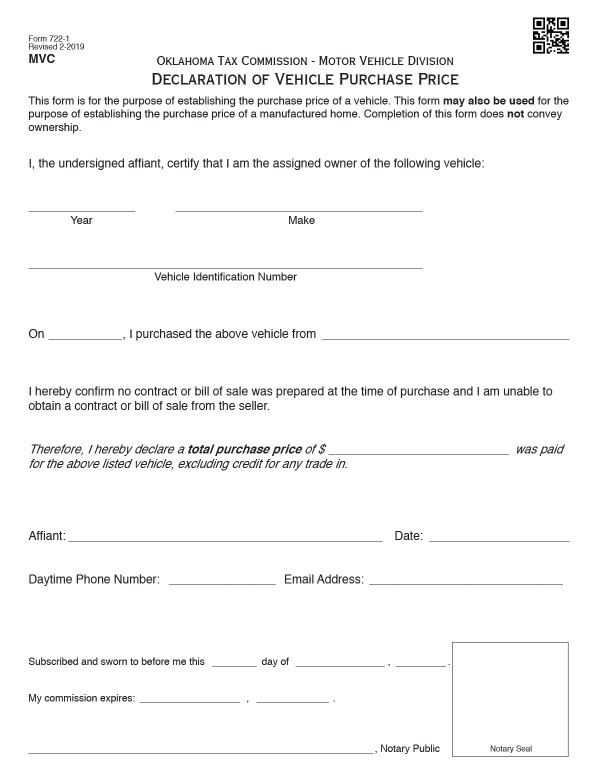

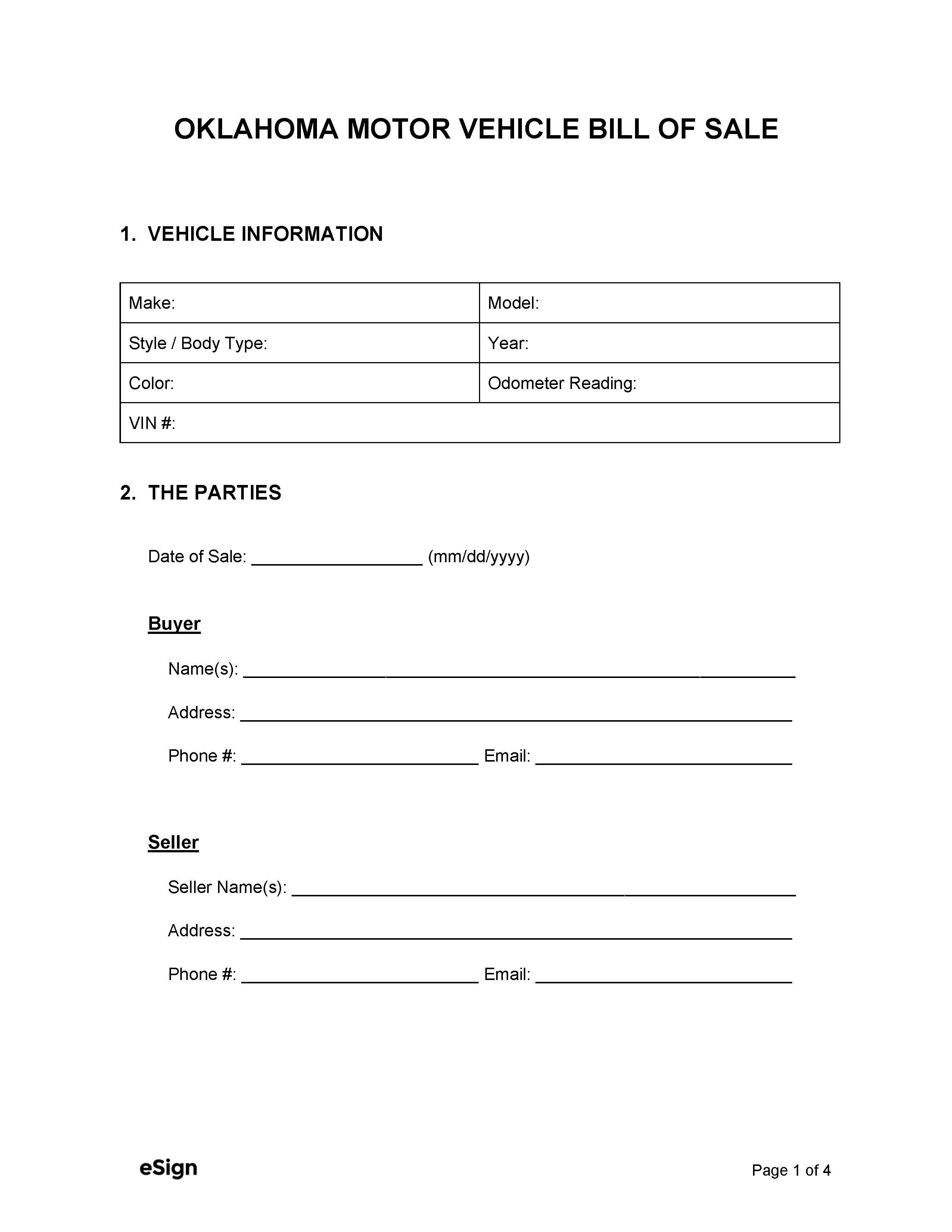

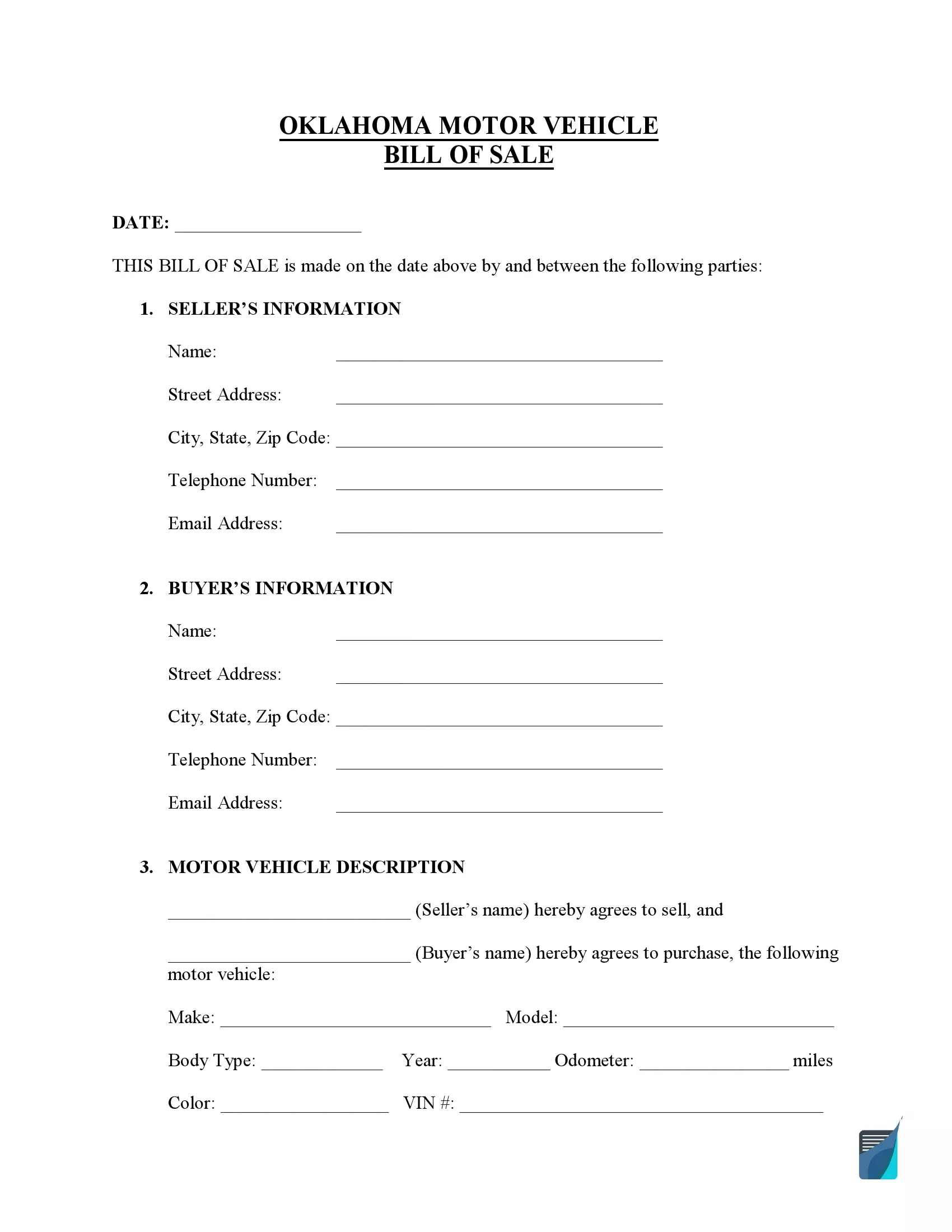

Bills Of Sale In Oklahoma The Templates Facts You Need

The cost for the first 1500 dollars is a flat 20 dollar fee.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The county the vehicle is registered in.

If the purchased price falls within 20 of the Blue Book value. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Your exact excise tax can only be calculated at a Tag Office. Oklahoma car sales tax calculator. How much will my tag tax and title cost in Oklahoma.

Oklahoma charges two taxes for the purchase of new motor vehicles. Multiply the vehicle price before trade-in or incentives by the sales tax fee. Build Price Locate A Dealer In Your Area.

How much sales and excise tax you will pay on your new purchase. In addition to taxes car purchases in Oklahoma may be subject to other fees like. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

325 of the. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. For example imagine you are purchasing a vehicle for.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. 45 percent of the purchase price minimum 5. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325.

We would like to show you a description here but the site wont allow us. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. New car sales tax OR used car sales tax.

Tax and Tags Calculator. Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard 45 combined tax rate for the remainder of the balance. Oklahoma has recent rate changes Thu Jul 01 2021.

Find Your 2022 Nissan Now. 325 percent of purchase price. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

125 sales tax and 325 excise tax for a total 45 tax rate. Taxes generally are paid to tag agents who are contracted by the Tax Commission as collection agents. This is only an estimate.

The type of license plates requested. Oklahoma has a. Ad Tech that changes every part of your drive with performance efficiency for the win.

Motor Vehicle Excise Tax Purchase Types New Vehicle. In addition to taxes car purchases in Oklahoma may be subject to other fees like. Oklahoma has a lower state sales tax.

There is also an annual registration fee of 26 to 96 depending on the age of the vehicle. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. If the purchased price falls within 20 of the.

When establishing an average retail value for the purpose of assessing excise tax Oklahoma law makes no provision. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. 20 up to a value of 1500 plus 325 percent on the remainder value.

The state in which you live. Whether or not you have a trade-in. An average value for all such models is utilized.

This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. We are a network of over 300 independent state-appointed tag agents that work with the Oklahoma Tax Commission Department of Public Safety and other state. Multiply the vehicle price after trade-ins and incentives by the sales tax fee.

Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File. When youre buying a vehicle its important to keep. The minimum is 725.

A Complete Guide On Car Sales Tax By State Shift

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Oklahoma Taxes Compare Oklahoma Policy Institute

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

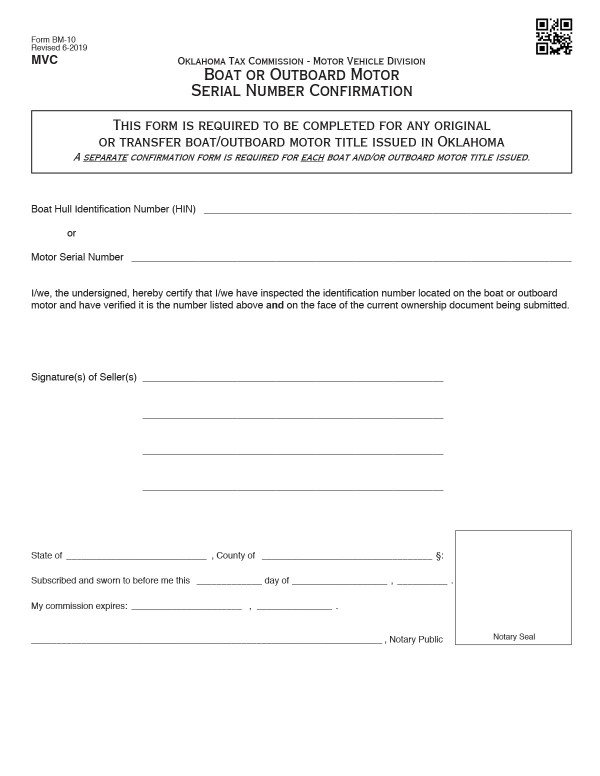

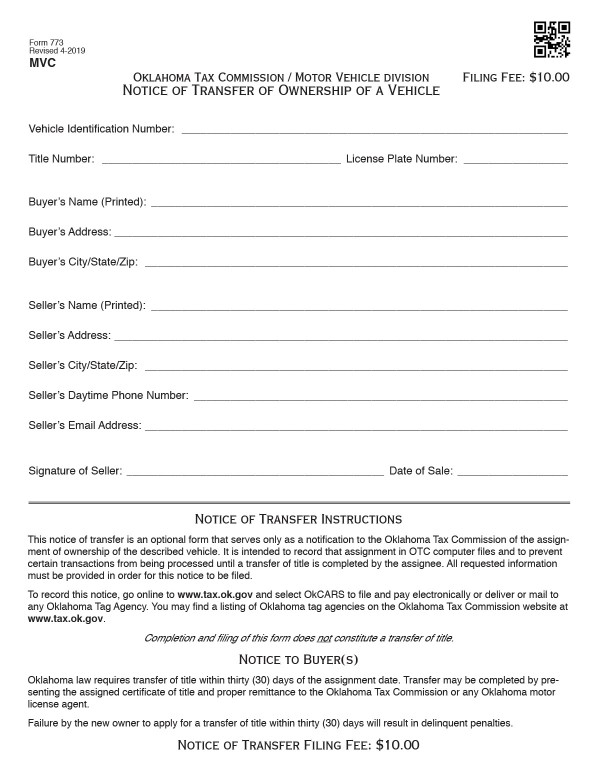

Bills Of Sale In Oklahoma The Templates Facts You Need

Bills Of Sale In Oklahoma The Templates Facts You Need

Free Oklahoma Bill Of Sale Form Pdf Word Legaltemplates

What S The Car Sales Tax In Each State Find The Best Car Price

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Oklahoma Sales Tax Small Business Guide Truic

Bills Of Sale In Oklahoma The Templates Facts You Need

Used Cars For Sale In Oklahoma City Ok Cars Com

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

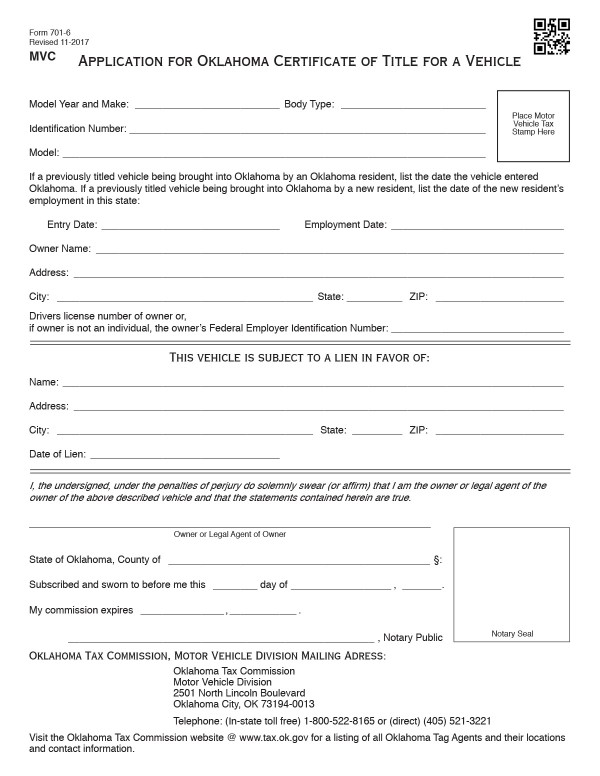

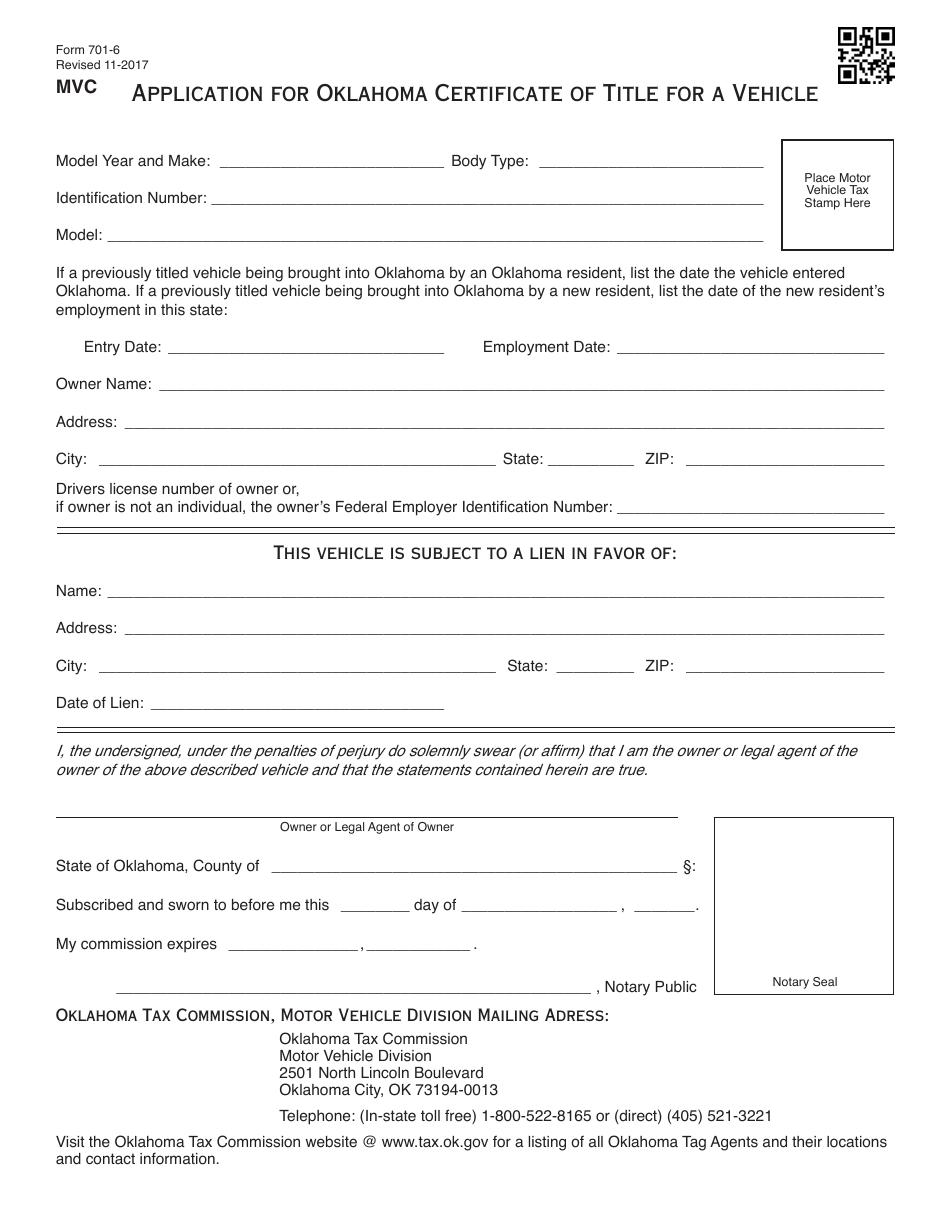

Otc Form 701 6 Download Fillable Pdf Or Fill Online Application For Oklahoma Certificate Of Title For A Vehicle Oklahoma Templateroller